Calculating Tax Basis For Partnership

Chapter 1 excel part ii How to calculate partnership tax basis Topic 2 accounting for income tax 1

Chapter 1 Excel Part II - How to Calculate Corporate Tax - YouTube

Corporate tax The cost basis of capital asset Tax corporate definition meaning rates federal states business taxes usa united companies individual charge profits levies government must these top

18+ oklahoma salary calculator

Tax liability calculation corporateIncome taxable tax corporate How to calculate income tax on salaryCorporate tax liability calculation.

Update on the qualified business income deduction for individualsHow to calculate tax Partner's adjusted tax basis in partnership interestCalculating basis in debt.

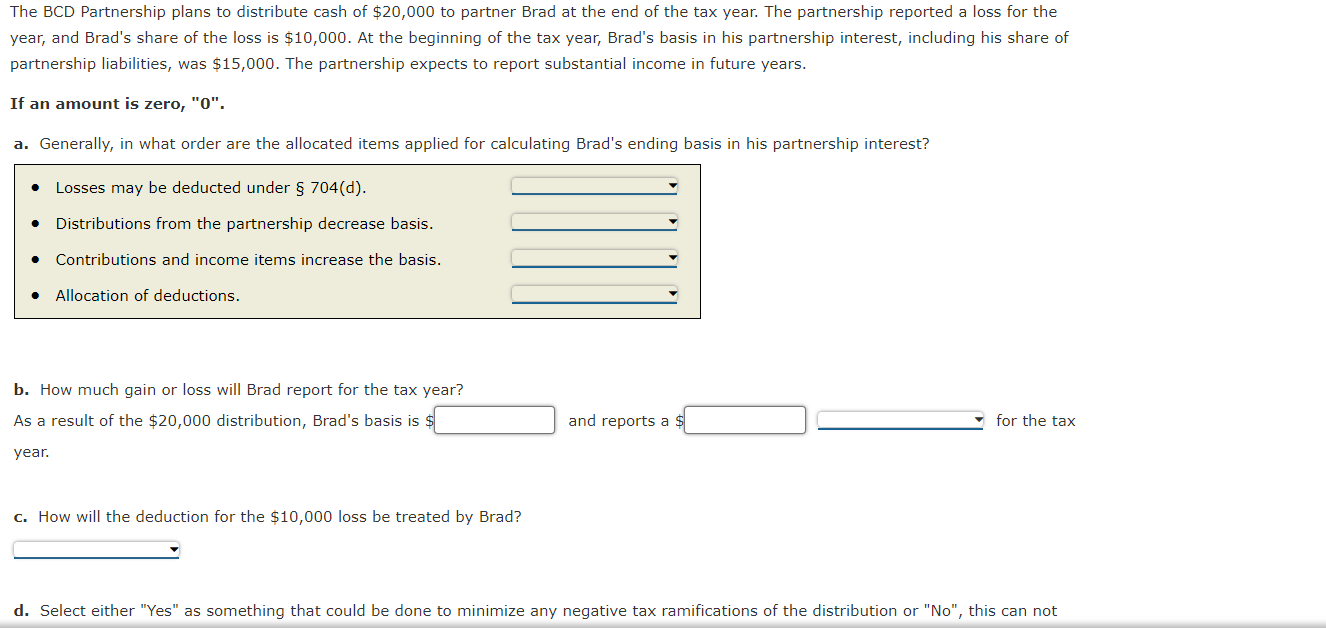

Solved the bcd partnership plans to distribute cash of

How to download your sa302 / tax calculations, tax returns (sa100), andTax calculator: estimate 2015 tax refunds for 2014 taxes Income tax calculator pakistan 2023 2024 fafsa27+ 600 000 mortgage calculator.

Income tax rates 2022 south africaForm rev-999 Partnership basis calculation worksheet excelRev basis outside partnership templateroller pennsylvania.

Budget 2022: your tax tables and tax calculator – sj&a chartered

Income tax rates 2022 australiaBasis partnership interest calculating Income currency belize hike gains bills gallon movesTax calculator taxes estimate online refund.

Basis debt calculating stock distributions not example distribution exhibit study do thetaxadviser issues decAccomplishing estate planning goals through the use of partnership Calculating corporate taxable income and income tax (p2-43)Income tax bracket calculation.

Income tax partnership accomplishing goals rules planning estate use llc total taxable interest through father other employment self

Partnership basis template for tax purposesPartnership taxable income chapter calculation presentation ppt powerpoint Capital gains income tax background information » publicationsCalculating adjusted tax basis in a partnership or llc: understanding.

Federal income tax calculator 2021How to calculate returns on company/corporate fixed deposits? what are Calculating basis in a partnership interestIncome business qualified deduction worksheet qbi calculation form individuals instructions update 1040 derived.

Tax checklist for moving states

Great income tax computation sheet in excel format stakeholder .

.

PPT - Chapter 4 Calculation of Partnership Taxable Income PowerPoint

Calculating Basis in a Partnership Interest - YouTube

Solved The BCD Partnership plans to distribute cash of | Chegg.com

How to download your SA302 / tax calculations, tax returns (SA100), and

Chapter 1 Excel Part II - How to Calculate Corporate Tax - YouTube

Partner's Adjusted Tax Basis in Partnership Interest

18+ Oklahoma Salary Calculator - JordanAriane